Modifying expense invoice details

This page allows you to modify the details of an expense invoice. Tell me more.

Select the “Edit Expense Invoice” link provided in the “Select Invoice” page.

The “Edit Expense Invoice” page appears.

The system displays the following in the “Invoice Information” group box:

Invoice # |

The number identifying the expense invoice. |

Expense Category |

Use the drop-down list box to specify the expense category for which the expense invoice is raised. The system lists all the ‘Active’ quick codes that are of type “Expense Category” as defined in the “Maintain Quick Codes” activity of the current business component. Ensure that the quick code specified here is in “active” status. The system displays blank by default. |

Status |

The status of the invoice. It could be “Draft”, “Fresh” or “Returned”.

|

Modify the following field if required in the “Invoice Information” group box:

Invoice Date |

The date on which the invoice is raised (Date Format). Mandatory. This invoice date must not be after the system date. This date must be a valid one in the “Open” financial year. |

Note: The invoice date must be the same as or prior to the earliest due date.

The system displays the following in the “Invoice Information” group box:

Finance Book |

The code identifying the finance book in which the invoice details must be posted. |

Codification Status |

Use the drop-down list box to specify the applicability of codification status. The system lists the following options if the parameter 'Applicability of Codification process for Supplier Expense Invoice' in the 'Set Finance Process Parameter's activity of the 'OU Parameter Setup' component is set as ‘Applicable’. This field loads only when the parameter 'Applicability of Codification process for Supplier Expense Invoice' in the 'Set Finance Process Parameters' activity of the 'OU Parameter Setup' component is set as ‘Applicable’ and when Codification Status option is also set.

The system leaves this field blank if no option is set for the parameter ‘Default Codification Status Supplier Expense Invoice” in the ‘Set Finance Process Parameter’ activity. The system defaults this field with the value defined for Codification Status in 'Set Finance Process Parameters'. |

Modify the following field in the “Invoice Information” group box:

Company Address ID |

The address ID of the company that is applicable for the invoice. The address ID you specify here must be defined for the finance book in the Create Finance Book activity of Organization Setup. On launch of the page, this field displays the preferred address ID for the finance book of the company. Help facility available |

The “Invoice Information” group box displays the following:

Company Address |

The address details for the selected address ID. On launch of the page, this field displays the address details of the preferred address ID of the finance book. |

The system displays the following in the “Supplier Information” group box:

Supplier Registered At |

The code identifying the organization unit in which the supplier has been created. |

Supplier # |

The code identifying the supplier. |

Supplier Name |

The name of the supplier. |

Modify the following field if required in the “Supplier Information” group box:

Pay To Supplier # |

Use the drop-down list box to select the code identifying the supplier to whom the payment can be made. . All the suppliers who have been designated, as “Pay to Supplier” for the supplier entered in the “Supplier Code” field will be available for selection. The pay to suppliers must be in an “Active” status. |

The system displays the following in the “Supplier Information” group box:

Pay to Supplier Name |

The name of the supplier to whom payment can be made. |

Modify the following fields if required in the “Supplier Information” group box:

Address ID |

The address ID of the supplier that is applicable for the invoice. By default, the preferred address ID of the supplier is displayed here. Help facility available |

The system displays the following in the “Supplier Information” group box: |

|

Address Details |

The address details for the address ID for the supplier. |

|

|

Supplier Invoice # |

A unique number identifying the invoice that has been issued by the supplier (Alphanumeric, 18). Mandatory |

Supplier Invoice Amount |

The amount for which the supplier invoice has been raised (Integer). Mandatory. The amount entered in this field must be greater than zero. |

Supplier Invoice Date |

The date on which the supplier invoice was raised (Date Format). Mandatory. This date must be the same or before the invoice date. |

Modify the following fields if required in the “Payment Information” group box:

Currency |

Use the drop-down list box to select the code identifying the currency in which the invoice must be created. All the currencies that have been mapped to the ““Payables Accounts” in the “Account Rule Definition” business component will be available for selection in the ascending order. The system displays the base currency of the company by default on launch of the page if it has been mapped to a “Payables Account”. |

The system displays the following in the “Payment Information” group box:

Exchange Rate |

The exchange rate of the invoice currency with respect to the base currency of the company if they are different. “1” (one) will be displayed if the invoice currency and the base currency are the same. |

Modify the following fields if required in the “Payment Information” group box:

Payment Processing Point |

Use the drop-down list box to select the code identifying the organization unit in which the payment for the invoice must be released. All the organization units from where a “Supplier Payment” business component has been mapped will be available for selection. The system displays the organization unit that has been set as “Default Payment Processing Point” in the “Set Functions Default” activity by default on launch of the page. |

Electronic Payment |

Use the drop-down list box to set whether electronic payment is possible for the invoice. You can select from “Yes” or “No”. |

Payment Method |

Use the drop-down list box to select the method in which the payment has to be made to the supplier. You can select from “Regular” or “Specific Bank”. |

Pay Mode |

Use the drop-down list box to select the mode in which the payment has to be made to the supplier. You can select from the various Cash, Check, Demand Draft, Direct Debit, or EFT pay modes that have been defined. |

Payment Priority |

Use the drop-down list box to set the priority to be accorded to the invoice. You can select from “High”, “Medium” or “Low”. |

Pay Term |

The code identifying the pay term (Alphanumeric, 15). Mandatory. This pay term must have been defined in the “Pay Term” business component and must be in “Active” status. |

|

Help facility available |

Anchor Date

|

The date from which the payment schedule of the invoice would be calculated (Date Format). |

Note: The date entered in this field must be after the date entered in the “Supplier Invoice Date” field.

The system displays the following in the “Payment Information” group box:

Total Invoice Amount |

The total invoice amount. The system calculates and displays this amount when the “Compute” pushbutton is clicked. This amount must be lesser or equal to the supplier invoice amount. |

Modify the following fields if required in the “Payment Information” group box:

Auto Adjust |

Use the drop-down list box to set whether the invoice must be automatically adjusted. You can select from “Yes” or “No”. |

Comments |

Any observations or remarks regarding the expense invoice (Alphanumeric, 255). |

|

Zoom facility available |

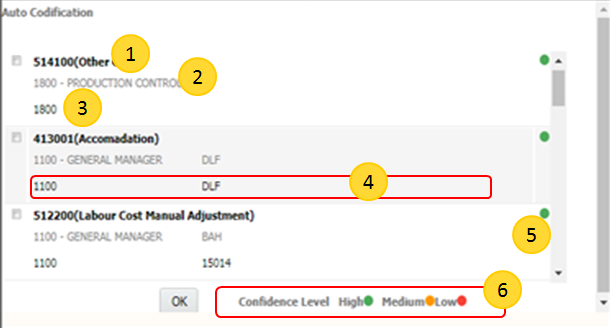

Select

the ![]() icon to predict account codification

for expense invoice using history data. More...

icon to predict account codification

for expense invoice using history data. More...

Modify the following fields in the “Electronic Payment Information” group box:

Pay Ref. ID |

The identification number of the payment note (Alphanumeric). |

Note: The above field is mandatory, if you have selected "Yes" in the Electronic Payment field.

The system displays the following in the "Electronic Payment Information" group box:

Pay Ref. Details |

The comments recorded for the specified payment reference ID in the Supplier Bank Information |

Modify the following in the “Electronic Payment Information” group box:

Payment Instructions |

Any guidelines for invoice payment relevant to the payment reference (Alphanumeric). |

Note: The system updates the Supplier Inquiry component with the electronic payment details that you specify here.

The system displays the following in the “Expense / T/C/D Information” multiline:

Line # |

The number identifying the line in which the part details are available. |

Modify the following field if required in the “Expense / T/C/D Information” multiline:

Expense / T/C/D # |

The code identifying the tax, charge or discount or the description of the expense (Alphanumeric, 32). |

The system displays the following in the “Expense / T/C/D Information” multiline:

Variant # |

The code identifying the tax, charge or discount variant. |

Modify the following fields if required in the “Expense / T/C/D Information” multiline:

Usage ID |

A code identifying the usage that has been mapped to the account code (Alphanumeric, 20). |

Help facility available |

|

UOM # |

The unit of measurement of the expense (Alphanumeric, 10). |

Help facility available |

|

Quantity |

The number of units of the item that is invoiced (Integer). The value entered in this field must be greater than zero. |

Note: This field must not be left blank if a value has been entered in the “Rate” field and the “Rate Per” field.

Rate |

The price of one unit of the item (Decimal). The value entered in this field must be greater than zero. |

Note: This field must not be left blank if a value has been entered in the “Quantity” field.

Rate Per |

The number of items, for which the rate is applicable (Integer). The value entered in this field must be greater than zero. |

Note: If this field is left blank, the system displays “1”.

Amount |

The amount invoiced for the item (Decimal). Mandatory. The value entered in this field must be greater than zero. |

Note: If this field is left blank, the system calculates the amount as the product of the item quantity and unit rate of the item, that is [“Quantity” * (“Rate” / “Rate per”)]

Remarks |

Any observations or comments regarding the expense available in the line (Alphanumeric, 255). |

Cost Center |

The code identifying the cost center to which the “Supplier Payable Account” (Alphanumeric, 10). The cost center must have been defined in the “Cost Setup” business component. Ensure the following:

|

Help facility available |

|

Analysis # |

The analysis code to which the “Supplier Payable Account” is mapped in the “Account Based Budgeting” business component (Alphanumeric, 5). Ensure that the analysis code specified here is mapped to the account code defined for the TCD-Variant # / Usage. |

Help facility available |

|

Sub Analysis # |

The sub analysis code to which the analysis code is mapped in the “Account Based Budgeting” business component (Alphanumeric, 5). Ensure that the subanalysis code specified here is mapped to the account code defined for the TCD-Variant # / Usage. |

The system displays the following in the “Expense/T/C/D Information” multiline:

Expense/T/C/D |

Indicates whether an “Expense”, “Tax”, “Charge” or “Discount” is available in the line. |

T/C/D Computation |

Indicates the method in which the tax, charge or discount has been calculated. It could be “For Document” or “For Line Item”.

|

T/C/D on Line # |

The number identifying the line in which the item for which the tax, charge or discount has been calculated. |

TCD Description |

The description of the code identifying the item, tax, charge or discount. |

Modify the following fields if required in the “Expense / T/C/D Information” multiline:

Expense Classification |

The classification of the expense incurred by the invoice. Data entry in this field is mandatory for income statement accounts if the option setting “Expense Classification is Required for Income Statement Accounts” is set as “Required” in the “Set Function Defaults” activity of the current business component. The system leaves a blank by default. |

Destination Finance Book |

The finance book to which expenses defined in multiple finance books will be posted. Ensure that a value is selected in this field if “Destination Usage ID” is entered. Ensure that the value selected in this field is not the same as the value entered in “Finance Book” for the invoice. Ensure that a value is specified in this field if Expense/T/C/D is other than tax, charge or discount type of expense. |

Destination Usage ID |

The usage ID to which expenses defined in multiple usage IDs will be posted. Ensure that a value is specified in this field if “Destination Finance Book” is selected. Ensure that a value is specified in this field if Expense/T/C/D is other than tax, charge or discount. |

Inter Finance Book JV No |

Finance book JV created for multiple finance book postings will be displayed. |

Note: The usage id provided in “Destination Usage” field must be an “InterFB” usage if a value is selected in the “Destination Finance Book” field.

Check the box in the “Select” column of the multiline to mark an expense for deletion.

Click the “Compute” pushbutton to calculate the total invoice amount.

On click of ‘Compute’, the system retrieves the tax code in the “Tax / Charge / Discount” page from the “Maintain Purchase Tax Rule” activity based on the doc type, expense category, company address ID and supplier address ID.

Note: For the calculation of the total invoice amount, the system does not consider Withholding Tax with Tax incidence as “On Payment”.

Note: If the option “Statutory Tax Computation Accounting Required” in the “Company Parameter Setup” business component is set to “Yes, TCD cannot be specified for InterFB type of expenses.

The system calculates and displays the total invoice amount.

Click the “Auto Codify” for codification of Expense Invoice.

Enter the following fields in the "Invoice Value Details" section:

Return Remarks |

Any comments pertaining to the return of the expense invoice. Mandatory. |

User Defined – 1 |

User defined remarks. |

User Defined – 2 |

User defined remarks. |

User Defined – 3 |

User defined remarks. |

Click the “Edit Invoice” pushbutton to save the modifications made to the expense invoice.

Note: For the selected invoice, the accounting for Withholding Tax with Tax Incidence as “On Payment” will not be recorded.

Note: When usage Id is InterFB and both “Destination FB” and “Destination Usage ID” is selected in the multiline, analysis code will relate only to the usage ID.

The system saves the modifications made to the expense invoice.

Account Postings details

The system credits the “Supplier Payable Account” in the account currency.

The system debits the “Expense Account”.

The system debits the “Rounding Off Account” in the base currency of the company, if the total invoice amount is greater than the total amount that has been rounded off. The system credits the “Rounding Off Account” in the base currency of the company, if the total invoice amount is lesser than the total amount that has been rounded off.

Payment Schedule

The system generates a payment schedule for the invoice based on the modifications made to the invoice.

The system also updates the login ID of the user and the system date in the “Last Modified By” and the “Last Modified Date” fields.

The system inherits tax in Supplier Direct Invoice based on the option ‘Allow Inheritances of Taxes Based on’ defined in the “Set Function Defaults” activity.

If the option ‘Allow Inheritances of Taxes Based on’ is as set as “Purchase Tax Rules”, the system inherits tax from “Manage Purchase Tax Rules” activity of the “Tax Charges & Discounts” business component.

If the option ‘Allow Inheritances of Taxes Based on’ is as set as “Statutory Tax Defaults”, the system displays tax based on the Tax Key defined for the supplier in the Supplier business component.

Click the “Edit and Authorize Invoice” pushbutton to save the modifications and authorize the expense invoice.

Note: For the selected invoice, the accounting for Withholding Tax with Tax Incidence as “On Payment” will not be recorded.

The system saves the modifications made to the expense invoice.

Status Update

The status of the invoice is updated as “Authorized”.

Account Postings details

The system credits the “Supplier Payable Account” in the account currency.

The system debits the “Expense Account”.

The system debits the “Rounding Off Account” in the base currency of the company, if the total invoice amount is greater than the total amount that has been rounded off. The system credits the “Rounding Off Account” in the base currency of the company, if the total invoice amount is lesser than the total amount that has been rounded off.

Payment Schedule

The system generates a payment schedule for the invoice based on the modifications made to the invoice.

The system also updates the login ID of the user and the system date in the “Last Modified By” and the “Last Modified Date” fields.

Click the “Delete invoice” pushbutton to delete the invoice.

The system updates the status of the invoice as “Deleted”. The system also updates the login ID of the user and the system in the “Last Modified By” and “Last Modified Date” fields.

The system displays the following:

Created By |

The login ID of the user who created the expense invoice. |

Created Date |

The date on which the expense invoice was created. |

Last Modified By |

The login ID of the user who last modified the expense invoice. |

Last Modified Date |

The date on which the expense invoice was last modified, which will be the system date. |

To proceed, carry out the following

Select the “T/C/D” link at the bottom of the page to enter the tax, charges or discount details for the invoice.

Select the “Payment Schedule” link at the bottom of the page to view or modify the payment schedule.

Select the “Edit Electronic Payment Information” link to modify the payment reference id and payment information details for an invoice.

Refer to the “Supplier Payment” online help for more details.

Select the "Amend Customer Order"link to modify the customer order associated with the invoice

Select the “Invoice Summary” link at the bottom of the page to view the summary of the invoice.

Select the “Accounting Information” link at the bottom of the page to view the account posting information of the invoice.

Select the “Attach Notes” link at the bottom of the page to record observations or comments regarding the newly created item invoice.

Select the “Create Adjustment” link to access the “Create Multi Currency Adjustment” activity to reconcile the unadjusted open debit documents for the supplier.

Usage ID

Usage Description

Cost Center

Analysis Code | Subanalysis Code

Color Code indicating Confidence Level

Confidence Level: The ranking for Cost Center, Analysis Code and Subanalysis Code indicating the maximum used combination

High - Highly used combination

Medicum - Medium Usage of the combination

Low-Least used combination

Sekect

the 'Ok' button to initiate defaults in the multiline based on which Expense

Invoice can be created.

Sekect

the 'Ok' button to initiate defaults in the multiline based on which Expense

Invoice can be created.

Modifying expense invoice details – An overview

You can modify the details on expense invoice that is in the “Draft”, “Fresh” or “Returned” status. You can modify almost all the details of the invoice except the details of the supplier who has issued the invoice. The system saves the modifications made to the invoice. The system generates a new payment schedule based on the modifications made to the invoice.

This page also allows you to authorize an expense invoice. You can modify the details of the expense invoice during the authorization process. You can authorize an invoice that is in the “Fresh” status. The system updates the status of an authorized invoice as “Authorized”. The system also stores the login ID of the user and the system date along with the modified details. You cannot modify the details of the invoice that is in the “Authorized” status. The system also generates a payment schedule based on the modifications made. This payment schedule cannot be modified after the invoice has been authorized.

This page also allows you to delete an expense invoice. The system updates the status of the invoice as “Deleted”. The system also stores the login ID of the user and the system date along with the modified details.