This page allows you to authorize an expense invoice. Tell me more.

Select the “Authorize Expense Invoice” link at the bottom of the “Select Invoice” page.

The “Authorize Expense Invoice” pagef appears.

The system displays the following in the “Invoice Information” group box:

Invoice # |

The number identifying the expense invoice. |

Expense Category |

Use the drop-down list box to specify the expense category for which the expense invoice is raised. The system lists all the ‘Active’ quick codes that are of type “Expense Category” as defined in the “Maintain Quick Codes” activity of the ‘Quick Code’ business component. Ensure that the quick code selected is in “active” status. |

Status |

The status of the invoice. It could be “Draft” or “Fresh”.

|

Modify the following field if required in the “Invoice Information” group box:

Invoice Date |

The date on which the invoice is raised (Date Format). Mandatory. This invoice date must not be after the system date. This date must be a valid one in the “Open” financial year. |

The system displays the following in the “Invoice Information” group box:

Finance Book |

The code identifying the finance book in which the invoice details must be posted. This finance book will be considered as Source Finance Book for multi-finance book invoice. |

Codification Status |

Use the drop-down list box to specify the applicability of codification status. The system lists the following options if the parameter 'Applicability of Codification process for Supplier

The system leaves this field blank if no option is set for the parameter ‘Default Codification Status Supplier Expense Invoice” in the ‘Set Finance Process Parameter’ activity.

|

|

In the editable field alongside, specify the name of the codifier. |

The system displays the following in the “Invoice Information” group box:

Company Address ID |

The address ID of the company that is applicable for the invoice. On launch of the page, this field displays the preferred address ID based on the default finance book of the company. Help facility available |

The system displays the following in the “Supplier Information” group box:

Supplier Registered At |

The code identifying the organization unit in which the supplier has been created. |

Supplier # |

The code identifying the supplier. |

Supplier Name |

The name of the supplier. |

Modify the following field if required in the “Supplier Information” group box:

Pay to Supplier # |

Use the drop-down list box to select the code identifying the supplier to whom the payment can be made. All the suppliers who have been designated, as “Pay to Supplier” for the supplier entered in the “Supplier Code” field will be available for selection. The pay to suppliers must be in an “Active” status. |

The system displays the following in the “Supplier Information” group box:

Pay to Supplier Name |

The name of the supplier to whom payment can be made. |

Modify the following fields if required in the “Supplier Information” group box:

Supplier Invoice # |

A unique number identifying the invoice that has been issued by the supplier (Alphanumeric, 18). Mandatory |

Supplier Invoice Amount |

The amount for which the supplier invoice has been raised (Integer). Mandatory. The amount entered in this field must be greater than zero. |

Supplier Invoice Date |

The date on which the supplier invoice was raised (Date Format). Mandatory. This date must be the same or before the invoice date. |

Modify the following fields if required in the “Payment Information” group box:

Currency |

Use the drop-down list box to select the code identifying the currency in which the invoice must be created. All the currencies that have been mapped to the ““Payables Accounts” in the “Account Rule Definition” business component will be available for selection in the ascending order. The system displays the base currency of the company by default on launch of the page if it has been mapped to a “Payables Account”. |

The system displays the following in the “Payment Information” group box:

Exchange Rate |

The exchange rate of the invoice currency with respect to the base currency of the company if they are different. “1” (one) will be displayed if the invoice currency and the base currency are the same. |

Modify the following fields if required in the “Payment Information” group box:

Payment Processing Point |

Use the drop-down list box to select the code identifying the organization unit in which the payment for the invoice must be released. All the organization units from where a “Supplier Payment” business component has been mapped will be available for selection. |

Electronic Payment |

Use the drop-down list box to set whether electronic payment is possible for the invoice. You can select from “Yes” or “No”. |

Payment Method |

Use the drop-down list box to select the method in which the payment has to be made to the supplier. You can select from “Regular” or “Specific Bank”. |

Pay Mode

|

Use the drop-down list box to select the mode in which the payment has to be made to the supplier. You can select from the various Cash, Check, Demand Draft, Direct Debit or EFT pay modes that have been defined. |

Payment Priority |

Use the drop-down list box to set the priority to be accorded to the invoice. You can select from “High”, “Medium” or “Low”. |

Pay Term

|

The code identifying the pay term (Alphanumeric, 15). Mandatory. This pay term must have been defined in the “Pay Term” business component and must be in “Active” status. |

|

Help facility available |

Anchor Date |

The date from which the payment schedule of the invoice would be calculated (Date Format). |

Note: The date entered in this field must be after the date entered in the “Supplier Invoice Date” field.

The system displays the following in the “Payment Information” group box:

Total Invoice Amount |

The total invoice amount. The system calculates and displays this amount when the “Compute” pushbutton is clicked. This amount must be lesser or equal to the supplier invoice amount. |

Modify the following fields if required in the “Payment Information” group box:

Auto Adjust |

Use the drop-down list box to set whether the invoice must be automatically adjusted. You can select from “Yes” or “No”. |

Comments |

Any observations or remarks regarding the expense invoice (Alphanumeric, 255). |

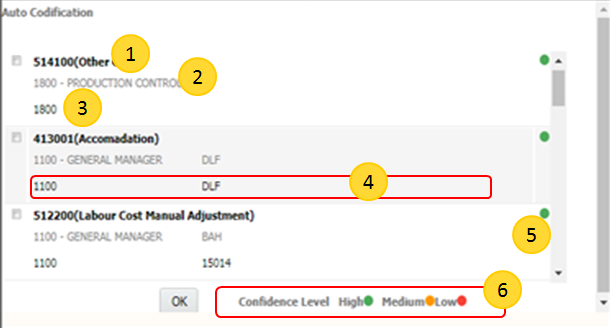

Select

the ![]() icon to predict account codification

for expense invoice using history data. More...

icon to predict account codification

for expense invoice using history data. More...

Modify the following fields if required in the “Electronic Payment Information” group box:

Pay Ref. ID |

The identification number of the payment note (Alphanumeric). |

Note: The above field is mandatory, if you have selected "Yes" in the Electronic Payment field.

The system displays the following in the "Electronic Payment Information" group box:

Pay Ref. Details |

The comments recorded for the pay reference ID in the Supplier Bank Information component. |

Modify the following if required in the “Electronic Payment Information” group box:

Payment Instructions |

Any guidelines for invoice payment relevant to the payment reference (Alphanumeric).

|

Note: The system updates the Supplier Inquiry component with the electronic payment details that you specify here.

The system displays the following in the “Expense / T/C/D Information” multiline:

Line # |

The number identifying the line in which the item details are available. |

Modify the following field if required in the “Expense / T/C/D Information” multiline:

Expense / T/C/D # |

The code identifying the tax, charge or discount or the description of the expense (Alphanumeric, 32). |

Variant # |

The code identifying the tax, charge or discount variant. |

Modify the following fields if required in the “Expense / T/C/D Information” multiline:

Usage ID |

A code identifying the usage that has been mapped to the account code (Alphanumeric, 20). |

Ensure that a value is entered in this field if "Destination Finance Book" is not selected for the line. Help facility available |

|

UOM # |

The unit of measurement of the expense (Alphanumeric, 10). Mandatory. |

Help facility available |

|

Quantity |

The number of units of the item that is invoiced (Integer). The value entered in this field must be greater than zero. |

Note: This field must not be left blank if a value has been entered in the “Rate” field and the “Rate Per” field.

Rate |

The price of one unit of the item (Decimal). The value entered in this field must be greater than zero. |

Note: This field must not be left blank if a value has been entered in the “Quantity” field.

Rate Per |

The number of items, for which the rate is applicable (Integer). The value entered in this field must be greater than zero. |

Note: If this field is left blank, the system displays “1”.

Amount |

The amount invoiced for the expense (Decimal). Mandatory. The value entered in this field must be greater than zero. |

Note: If this field is left blank, the system calculates the amount as the product of the item quantity and unit rate of the item, that is [“Quantity” * (“Rate” / “Rate per”)]

Remarks |

Any observations or comments regarding the expense available in the line (Alphanumeric, 255). |

Cost Center |

The code identifying the cost center to which the expenses have to be posted. (Alphanumeric, 10). The cost center must have been defined in the “Cost Setup” business component. Ensure that a value is entered in this field if cost center is mapped to the account code to which the usage id/destination usage id is mapped. |

Help facility available |

|

Analysis # |

The analysis code to which the expenses have to be posted. The analysis # must have been defined in the “Account Based Budgeting” business component (Alphanumeric, 5). Ensure that a value is entered in this field if analysis # is mapped to the account code to which the usage id/destination usage id is mapped. |

Help facility available |

|

Sub Analysis # |

The sub-analysis code to which the expenses have to be posted. The sub-analysis # must have been defined in the “Account Based Budgeting” business component (Alphanumeric, 5). Ensure that a value is entered in this field if sub-analysis # is mapped to the account code to which the usage id/destination usage id is mapped. |

The system displays the following in the “Expense / T/C/D Information” multiline:

Expense / T/C/D |

Indicates whether an “Expense”, “Tax”, “Charge” or “Discount” is available in the line. |

T/C/D Computation |

Indicates the method in which the tax, charge or discount has been calculated. It could be “For Document” or “For Line Item”.

|

T/C/D on Line # |

The number identifying the line in which the item for which the tax, charge or discount has been calculated. |

TCD Description |

The description of the code identifying the tax, charge or discount. |

Modify the following fields if required in the “Expense / T/C/D Information” multiline:

Expense Classification |

The classification of the expense incurred by the invoice. Data entry in this field is mandatory for income statement accounts if the option setting “Expense Classification is Required for Income Statement Accounts” is set as “Required” in the “Set Function Defaults” activity of the current business component. The system displays the expense classification specified for the invoice by default. Help facility available. |

Destination Finance Book |

Use the drop-down list box to specify the finance book to which expenses defined in multiple finance books will be posted. The system lists all the finance book s defined for the Company. Ensure that a value is selected in this field if “Destination Usage ID” is entered. Ensure that the value selected in this field is not the same as the value entered in “Finance Book” for the invoice. The system displays the destination finance book defined for the invoice by default. |

| Destination Usage ID | The usage ID to which expenses have to be posted in the destination finance book. Ensure that a value is specified in this field if “Destination Finance Book” is selected or is the usage id is “InterFB”.. Help facility available |

Note: The usage Id provided in “Usage Id” field must be an “InterFB” usage if a value is selected in the “Destination Finance Book” field.

The system displays the following in the “Expense / T/C/D Information” multiline:

Inter Finance Book JV No |

The code identifying the inter finance book journal voucher number. For multiple finance book postings, an automated Inter Finance Book JV will get automatically generated on authorization of the invoice. The automated JV will get generated if the option setting ‘Allow multiple finance book postings’ in “Set options” activity of the current business component is set as ‘Yes’. |

Check the box in the “Select” column of the multiline to mark an expense for deletion.

Click the “Compute” pushbutton to calculate the total invoice amount.

Note: For the calculation of the total invoice amount, the system does not consider Withholding Tax with Tax incidence as “On Payment”.

The system performs the following:

Updates the Usage Id as ‘INTERFB’ when Usage ID is left blank, but Destination FB is specified.

The system calculates and displays the total invoice amount

Click the “Edit Invoice” pushbutton to save the modifications made to the expense invoice.

Note: For the selected invoice, the accounting for Withholding Tax with Tax Incidence as “On Payment” will not be recorded.

Note: When usage Id is InterFB and both “Destination FB” and “Destination Usage ID” is selected in the multiline, cost center, analysis code and sub-analysis will relate only to the destination usage Id.

Click the “Auto Codify” pushbutton for codification of Expenses Invoice.

The system saves the modifications made to the expense invoice.

Account Postings details

The system credits the “Supplier Payable Account” in the account currency.

The system debits the “Expense Account / InterFB” account.

The system debits the “Rounding Off Account” in the base currency of the company, if the total invoice amount is greater than the total amount that has been rounded off. The system credits the “Rounding Off Account” in the base currency of the company, if the total invoice amount is lesser than the total amount that has been rounded off.

Payment Schedule

The system generates the default payment schedule for the invoice.

The system also updates the login ID of the user and the system date in the “Last Modified By” and the “Last Modified Date” fields.

Click the “Edit and Authorize Invoice” pushbutton to save the modifications and authorize the expense invoice.

Note: For the selected invoice, the accounting for Withholding Tax with Tax Incidence as “On Payment” will not be recorded

The system saves the modifications made to the expense invoice.

Status Update

The status of the invoice is updated as “Authorized”.

Account Postings details

The system credits the “Supplier Payable Account” in the account currency.

The system debits the “Expense Account”.

The system debits the “Rounding Off Account” in the base currency of the company, if the total invoice amount is greater than the total amount that has been rounded off. The system credits the “Rounding Off Account” in the base currency of the company, if the total invoice amount is lesser than the total amount that has been rounded off.

The system also updates the login ID of the user and the system date in the “Last Modified By” and the “Last Modified Date” fields.

Click the “Return invoice” pushbutton to return the invoice for modification.

Note: For the selected invoice, the accounting for Withholding Tax with Tax Incidence as “On Payment” will not be recorded.

The system saves the modifications made to the expense invoice.

Status Update

The status of the invoice is updated as “Returned”.

The system also updates the login ID of the user and the system in the “Last Modified By” and “Last Modified Date” fields.

The system displays the following:

Created By |

The login ID of the user who created the expense invoice. |

Created Date |

The date on which the expense invoice was created. |

Last Modified By |

The login ID of the user who last modified the expense invoice. |

Last Modified Date |

The date on which the expense invoice was last modified, which will be the system date. |

To proceed, carry out the following

Select the “T/C/D” link at the bottom of the page to modify the tax, charges or discount details for the invoice.

Select the “Edit Electronic Payment Information” link to modify the payment reference id and payment information details for an invoice.

Refer to the “Supplier Payment” online help for more details.

Select the "Amend Customer Order" link at the bottom of the page to modify customer details.

Select the “Invoice Summary” link at the bottom of the page to view the summary of the invoice.

Select the “Accounting Information” link at the bottom of the page to view the account posting information of the

Select the “Attach Notes” link at the bottom of the page to record observations or comments regarding the invoice. invoice.

Select the “Create Adjustment” link to access the “Create Multi Currency Adjustment” activity to reconcile the unadjusted open debit documents for the supplier.

Authorizing expense invoice – An overview

You can authorize an expense invoice that is in the “Draft” or “Fresh” status. The system updates the status of the invoice as “Authorized”. The system also stores the login ID of the user and the system date along with the invoice details. You cannot modify the details of an authorized invoice any further. The payment schedule that has been generated for the invoice would be frozen. An authorized invoice will be adjusted with the selected debit documents.

This page also allows you to modify the details of an expense invoice while trying to authorize it. The system saves the modifications made to the invoice. The system also retains the same status of the invoice. This page also allows you to return the invoice to the user who created it for modifications. You can return an invoice that is in the “Fresh” status. The system updates the status of the returned invoice as “Returned”. The system also stores the login ID of the user and the system date along with the invoice details.

Usage ID

Usage Description

Cost Center

Analysis Code | Subanalysis Code

Color Code indicating Confidence Level

Confidence Level: The ranking for Cost Center, Analysis Code and Subanalysis Code indicating the maximum used combination

High - Highly used combination

Medicum - Medium Usage of the combination

Low-Least used combination

Sekect

the 'Ok' button to initiate defaults in the multiline based on which Expense

Invoice can be created.

Sekect

the 'Ok' button to initiate defaults in the multiline based on which Expense

Invoice can be created.